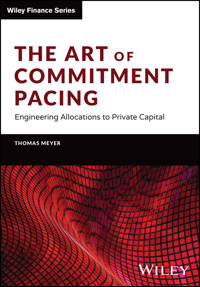

53,99 €

Mehr erfahren.

- Herausgeber: John Wiley & Sons

- Kategorie: Fachliteratur

- Serie: Wiley Finance Series

- Sprache: Englisch

Arms investors with powerful new tools for measuring and managing the risks associated with the various illiquid asset classes With risk-free interest rates and risk premiums at record lows, many investors are turning to illiquid assets, such as real estate, private equity, infrastructure and timber, in search of superior returns and greater portfolio diversity. But as many analysts, investors and wealth managers are discovering, such investments bring with them a unique set of risks that cannot be measured by standard asset allocation models. Written by a dream team of globally renowned experts in the field, this book provides a clear, accessible overview of illiquid fund investments, focusing on what the main risks of these asset classes are and how to measure those risks in today's regulatory environment. * Provides solutions for institutional investors in need of guidance in today's regulatory environment * Offers detailed descriptions of risk measurement in illiquid asset classes, illustrated with real life case studies * Helps you to develop reliable risk management tools while complying with the regulations designed to contain the individual and systemic risks arising from illiquid investments * Features real-life case studies that capture an array of risk management scenarios you are likely to encounter

Sie lesen das E-Book in den Legimi-Apps auf:

Seitenzahl: 619

Veröffentlichungsjahr: 2013

Ähnliche

Contents

Cover

Title Page

Copyright

Dedication

Foreword

Acknowledgements

Chapter 1: Introduction

1.1 Alternative investing and the need to upgrade risk management systems

1.2 Scope of the book

1.3 Organization of the book

Part I: Illiquid Investments as an Asset Class

Chapter 2: Illiquid Assets, Market Size and the Investor Base

2.1 Defining illiquid assets

2.2 Market size

2.3 The investor base

2.4 Conclusions

Chapter 3: Prudent Investing and Alternative Assets

3.1 Historical background

3.2 Prudent investor rule

3.3 The OECD guidelines on pension fund asset management

3.4 Prudence and uncertainty

3.5 Conclusion

Chapter 4: Investing in Illiquid Assets through Limited Partnership Funds

4.1 Limited partnership funds

4.2 Limited partnerships as structures to address uncertainty and ensure control

4.3 The limited partnership fund's illiquidity

4.4 Criticisms of the limited partnership structure

4.5 Competing approaches to investing in private equity and real assets

4.6 A time-proven structure

4.7 Conclusion

Chapter 5: Returns, Risk Premiums and Risk Factor Allocation

5.1 Returns and risk in private equity

5.2 Conclusions

Chapter 6: The Secondary Market

6.1 The structure of the secondary market

6.2 Market size

6.3 Price formation and returns

6.4 Conclusions

Part II: Risk Measurement and Modelling

Chapter 7: Illiquid Assets and Risk

7.1 Risk, uncertainty and their relationship with returns

7.2 Risk management, due diligence and monitoring

7.3 Conclusions

Chapter 8: Limited Partnership Fund Exposure to Financial Risks

8.1 Exposure and risk components

8.2 Funding test

8.3 Cross-border transactions and foreign exchange risk

8.4 Conclusions

Chapter 9: Value-at-Risk

9.1 Definition

9.2 Value-at-risk based on NAV time series

9.3 Cash flow volatility-based value-at-risk

9.4 Diversification

9.5 Factoring in opportunity costs

9.6 Cash-flow-at-risk

9.7 Conclusions

Chapter 10: The Impact of Undrawn Commitments

10.1 Do overcommitments represent leverage?

10.2 How should undrawn commitments be valued?

10.3 A possible way forward

10.4 Conclusions

Chapter 11: Cash Flow Modelling

11.1 Projections and forecasts

11.2 What is a model?

11.3 Non-probabilistic models

11.4 Probabilistic models

11.5 Scenarios

11.6 Blending of projections generated by various models

11.7 Stress testing

11.8 Back-testing

11.9 Conclusions

Chapter 12: Distribution Waterfall

12.1 Importance as incentive

12.2 Fund hurdles

12.3 Basic waterfall structure

12.4 Examples for carried interest calculation

12.5 Conclusions

Chapter 13: Modelling Qualitative Data

13.1 Quantitative vs. qualitative approaches

13.2 Fund rating/grading

13.3 Approaches to fund ratings

13.4 Use of rating/grading as input for models

13.5 Assessing the degree of similarity with comparable funds

13.6 Conclusions

Chapter 14: Translating Fund Grades into Quantification

14.1 Expected performance grades

14.2 Linking grades with quantifications

14.3 Operational status grades

14.4 Conclusions

Part III: Risk Management and Its Governance

Chapter 15: Securitization

15.1 Definition of securitization

15.2 Financial structure

15.3 Risk modelling and rating of senior notes

15.4 Transformation of non-tradable risk factors into tradable financial securities

15.5 Conclusions

Chapter 16: Role of the Risk Manager

16.1 Setting the risk management agenda

16.2 Risk management as part of a firm's corporate governance

16.3 Built-in tensions

16.4 Conclusions

Chapter 17: Risk Management Policy

17.1 Rules or principles?

17.2 Risk management policy context

17.3 Developing a risk management policy

17.4 Conclusions

References

Abbreviations

Index

© 2013 John Wiley & Sons, Ltd

Registered officeJohn Wiley & Sons, Ltd, The Atrium, Southern Gate, Chichester, West Sussex, PO19 8SQ, United Kingdom

For details of our global editorial offices, for customer services and for information about how to apply for permission to reuse the copyright material in this book please see our website at www.wiley.com.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, except as permitted by the UK Copyright, Designs and Patents Act 1988, without the prior permission of the publisher.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com. For more information about Wiley products, visit www.wiley.com.

Designations used by companies to distinguish their products are often claimed as trademarks. All brand names and product names used in this book are trade names, service marks, trademarks or registered trademarks of their respective owners. The publisher is not associated with any product or vendor mentioned in this book.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with the respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. It is sold on the understanding that the publisher is not engaged in rendering professional services and neither the publisher nor the author shall be liable for damages arising herefrom. If professional advice or other expert assistance is required, the services of a competent professional should be sought.

Library of Congress Cataloging-in-Publication Data

Cornelius, Peter, 1960- Mastering illiquidity: risk management for portfolios of limited partnership funds / Peter Cornelius, ChristianDiller, Didier Guennoc and Thomas Meyer. pages cm Includes bibliographical references and index. ISBN 978-1-119-95242-8 (cloth) 1. Private equity funds. 2. Portfolio management. 3. Risk management. I. Diller, Christian, 1976-II. Guennoc, Didier, 1967- III. Meyer, Thomas, 1959- IV. Title. HG4751.C754 2013 332.63′27-dc23 2013004405

A catalogue record for this book is available from the British Library.

ISBN 978-1-119-95242-8 (hardback) ISBN 978-1-119-95280-0 (ebk)ISBN 978-1-119-95281-7 (ebk) ISBN 978-1-119-95282-4 (ebk)

Cover image: Shutterstock.com

To our families: Peter Cornelius: Susanne; and Heike and Paul Christian Diller: Susanne, Moritz and Mara Didier Guennoc: Brigitte, Lorenz-Gabriel and Ninon-MarieThomas Meyer: Mika Kaneyuki

Foreword

Over the last three decades, private equity has established itself as one of the most important asset classes for institutional investors. Despite going through boom and bust periods, investments in private equity have grown steadily over time. Two important economic forces have helped drive this growth.

First, illiquid assets, such as private equity, comprise an important part of the overall market portfolio and thus provide investors with important diversification benefits. The vast majority of assets around the world are private, and despite the recent growth of private equity these assets are still underrepresented in the portfolios of institutional investors.

Second, as institutional investors have grown larger and more diversified, it is becoming harder for institutions to exercise active ownership and governance in all the companies they own. This is a serious problem, since active ownership and governance are crucial in order to realize the full value potential of a firm. By investing part of their assets in private equity funds, large institutions can delegate their active ownership to skilled intermediaries, which in turn can acquire large ownership stakes in companies and act as active owners, while still allowing the institutional investors to maintain a high degree of diversification in their overall portfolios.

Recent research has confirmed that this model seems to work: firms seem to be run more efficiently under private equity ownership, and private equity has been a major contributor to institutional investor returns. Because of this, the long-term trend in private equity growth is not likely to reverse anytime soon.

Given its growth and importance, it is both worrying and surprising that private equity is so misunderstood. Despite the positive research evidence on the impact of private equity ownership on firms, the public perception of private equity is often quite negative. Private equity funds are depicted as vultures and asset strippers, who use financial engineering to squeeze out short-term profits from firms at the expense of employment and long-term growth. These perceptions have led legislators to impose misdirected regulation, such as the European AIFM directive, which at best simply imposes some additional red tape on funds, and at worst threatens the supply of capital to European small and medium-sized enterprises. A large part of the blame for this misunderstanding should fall on the private equity industry itself, which for too long believed it was fine to lack in transparency towards the public as long as it was transparent towards their investors.

It is even more worrisome, however, that investors themselves often misunderstand the private equity asset class. Many investors enter the private equity arena relying on their experience from investing in liquid stocks and bonds, without fully realizing that investing in illiquid assets requires a completely different skill set and investment approach.

Investors are often unable to appropriately assess and evaluate their returns from private equity. The type of short-term, quarter-by-quarter benchmarking that can be done for liquid investments fails to work for evaluating private equity. The regular net asset values reported by private equity funds are very different from market valuations, and relying on these for performance evaluation will be very misleading.

The true costs of private equity investing are also much less transparent, both because of the complex fee structures of private equity funds and the substantial organizational resources an institution has to devote to assess, execute, and monitor private equity investments. In addition, the opportunity cost of future liquidity commitments is often ignored. Numerous investors have experienced disappointing private equity returns, either because they felt forced to hold an excess of low-yielding liquid assets in order to meet future private equity fund commitments, or because they were forced to sell their private equity interests at fire-sale prices in the secondary market when they were not able to fulfill their commitments. These various costs will vary substantially across different types of investors, depending on their size, liability structure, and investment horizon. While the costs may be negligible for some investors, they may be insurmountable for others.

Evaluating private equity funds is also very different from evaluating liquid investment opportunities and asset managers. Liquid investment strategies are often about market timing, with investors swiftly responding to changes in relative risk premia across different assets and markets. Investment strategies that were successful in the past are unlikely to persist for long into the future, as capital can quickly move across liquid asset classes. Private equity investment, by contrast, is primarily about identifying consistent performers, who have the proprietary skills to add operational and strategic value to their investments over a long period of time.

The liquid investment mindset also leads investors to misunderstand the risks of private equity investments. For liquid assets, we have seen large leaps forward in terms of risk measurement and risk management in the last decades. Using modern portfolio theory, risk factors can now be estimated and incorporated in asset allocation models to capture exotic risk premia and improve diversification. Risk management tools such as VAR-models are estimated using high-frequency data in order to control and limit downside portfolio risks. These tools have also been picked up by regulators around the world and incorporated in capital regulations such as the Basle and Solvency rules.

Applying these standard models to private equity, however, often gives a highly misleading view of the real risks involved. Relying on fluctuations in infrequently updated net asset values are highly inappropriate for measuring risks, guiding strategic asset allocation, and forming the basis of risk management. In contrast, the liquidity risks are often either ignored or inappropriately modeled, leading to spectacular risk management failures and large costs to investors. In addition, if regulators fail to adjust their models, this can encourage institutions to take excessive illiquidity risk and result in the under-capitalization of such investors. Conversely, inappropriate regulation may penalize investors for taking perceived risks that in reality are not present or important.

Hence, the private equity industry faces a huge challenge in educating the public, investors, and regulators about this asset class. This is where this book fills an extremely important void. The authors, Cornelius, Diller, Guennoc, and Meyer, are some of the world's foremost experts on private equity investing. They uniquely combine extensive practical investment experience with deep knowledge of state-of-the-art research and methodologies. The authors provide an extensive coverage of all major aspects of the private equity market from an institutional investor's point of view, including fund structures, return and risk measurement, and risk modeling and management, in a way that is both advanced and highly practical. In addition, the book contains numerous discussions of more specialized topics, such as secondary markets and recent industry trends, such as securitization, which are enlightening and informative even for those very familiar with the private equity industry. The book should be required reading for those investing in private equity, novices and experienced investors alike. I congratulate the authors on an impressive and important effort!

Per StrömbergCentennial Professor of Finance and Private EquityStockholm School of EconomicsStockholm April 1, 2013

Acknowledgements

Alternative investing in illiquid assets has become increasingly popular in the past few decades. For some long-term investors, especially family offices and endowments, the label “alternative” may no longer be appropriate as their exposure to private equity and real assets has risen to 20 – 30 percent, in some cases even more. While pension funds and insurance firms usually allocate a comparatively smaller share of their capital to alternative asset classes – reflecting, among other things, different liability profiles and regulatory requirements – their exposure has also increased considerably over time.

Alternative investing is expected to gain further momentum as investors chase yields in an environment where policy rates look set to remain low. Higher expected returns typically come with higher risk. But not only that. The nature of risks in alternative investing in illiquid assets is fundamentally different from risks that investors are exposed to when allocating capital to marketable assets. This is a key lesson investors have learned in the recent global financial crisis, which culminated in the collapse of Lehman Brothers in the fall of 2008. In light of this experience, a growing number of them have adopted new asset allocation models that focus on asset class-specific risk premiums.

Harvesting asset class-specific risk premiums requires asset class-specific risk management techniques. However, as far as investments in private equity funds and similar structures are concerned, the development of such techniques has not kept pace with the rapid increase in investors' exposure to these assets. Almost half a decade after the Great Recession, investors still find surprisingly little guidance in the existing literature in measuring risk in their illiquid portfolios and managing this risk efficiently. Meanwhile, regulators have identified the widening gap between the rise in alternative investing and the use of appropriate tools to measure and manage the risks associated with such investments as a key issue. New regulatory initiatives, such as Solvency II, encourage investors to develop their own proprietary models, in the absence of which they will have to adopt a standard model that imposes high capital requirements for private equity and similar assets.

In aiming at narrowing the gap between the growing importance of alternative investing and the availability of appropriate risk management tools, this book ventures, almost by definition, into unknown territory. Luckily, in our journey into terra incognita we were able to tap into the deep pool of knowledge of a wide range of investment professionals, risk managers and academics. All of them deserve our deep gratitude for making their invaluable insights and precious time available to us.

First and foremost, we would like to thank our fellow members of the working group on developing risk measurement guidelines, a group of practitioners that was set up by the European Venture Capital and Private Equity Association (EVCA) in the spring of 2010. Specifically, our sincere thanks go to Davide Deagostino (BT Pension Scheme); Ivan Herger (Capital Dynamics); Niklas Johansson (Cogent Partners); Lars Körner (Deutsche Bank Private Equity); Pierre-Yves Mathonet (formerly European Investment Fund and now ADIA); and the group's secretary Cornelius Müller (EVCA). Specifically, this working group was tasked to set up a framework for measuring and managing risk in private equity, within which investors may develop their own proprietary risk models in compliance with existing and emerging regulation. The initiative was supported by Dörte Höppner, EVCA's secretary general, to whom the authors, and indeed the entire working group, are deeply indebted.

Furthermore, we would like to thank the members of EVCA's Professional Standards Committee, and especially its chairman Vincent Neate (KPMG), for providing extremely helpful comments and suggestions throughout the process. The guidelines were finally approved by EVCA's Board, chaired by Vincenzo Morelli (TPG), in the fall of 2012. The authors would like to express their gratitude for the Board's support of the guidelines, which have evolved into the present study.

There are few areas where the symbiosis between academic research and practical applications is more intensive than in financial economics and risk management. In drafting EVCA's risk measurement guidelines, the working group greatly benefited from a first-class academic advisory board consisting of Ulf Axelson (London School of Economics and Political Science), Morten Sørenson (Columbia Business School) and Per Strömberg (Stockholm School of Economics and University of Chicago Booth School of Business). Their advice has been extremely important in ensuring the academic rigor the subject at hand requires. Professors Axelson, Sorenson and Strömberg have also served as an important sounding board in preparing the manuscript of this book, for which we are extremely grateful.

Other world-class academics have also commented extensively on earlier drafts or individual chapters and provided extremely useful guidance in developing a coherent risk management framework for illiquid assets. These include Oliver Gottschalg (HEC Paris); Robert Harris (University of Virginia); Tim Jenkinson (Oxford Said Business School); Christoph Kaserer (Technical University Munich); Josh Lerner (Harvard Business School); Ludovic Phalippou (Oxford Said Business School); and Peter Roosenboom (Rotterdam School of Management). All of them deserve our special thanks.

While this book aims to reflect the latest academic thinking on a subject that is constantly evolving, the main addressees of the present study are limited partners in private equity funds and similar structures. Many investment and risk management practitioners have shared their deep knowledge and experience with us and provided detailed comments on individual draft chapters or the entire manuscript. At AlpInvest Partners, we would like to thank the firm's partners for their continuous encouragement and their support in getting this project to the finish line. Furthermore, we have benefited greatly from specific comments and suggestions by Edo Aalbers and Robert de Veer of AlpInvest Partners' Portfolio and Risk team. At Montana Capital Partners, our sincere thanks go to Lara Lendenmann and Marco Wulff. We are also deeply indebted to John Breen (Sanabil); Pascal Cettier (Aeris Capital); Philippe Desfossés (ERAFP); Pieter van Foreest (APG); Ivan Popovic (Aeris Capital); John Renkema (APG); Alfred Rölli (Pictet); Christophe Rouvinez (Müller-Möhl Group); Pierre Stadler (Pictet) and Ashok Samuel (GIC). All of them have been extremely generous with their precious time in reading the manuscript and helping us determine best practices in measuring and managing risk in illiquid assets other investors will hopefully benefit from.

We also owe special thanks to our publishing team at Wiley, especially Werner Coetzee, Samantha Hartley and Jennie Kitchin. Sarah Lewis has done an outstanding job as our copy editor. Prakash Naorem of Aptara has very aptly led the production process, for which we are most grateful.

The greatest amount of gratitude is due to our families, however. Indeed, this book would not have been possible without their constant support and understanding and the time they have given us over the past few years. We would therefore like to dedicate this book to them.

Peter CorneliusChristian DillerDidier GuennocThomas Meyer

1

Introduction

Investing in private equity, hedge funds and real assets – such as infrastructure, real estate, forestry and farmland, energy and commodities – has gained considerable momentum in recent years. These assets are often called “alternatives” as their investment history is still relatively short and, unlike traditional asset classes, they are rarely traded in public markets.1 Investors have been attracted by the superior returns that alternative assets may offer. Moreover, as returns are found to be correlated less with traditional asset classes, alternative assets have been regarded as attractive investments helping asset allocators diversify their portfolios. At the same time, it has been argued that the potential returns of traditional asset classes have diminished. Specifically, public stock markets have become increasingly efficient, limiting investors' potential to achieve excess returns by investing in undervalued stocks. In the bond market, yields have declined substantially since the 1980s thanks to successful central bank policies aimed at reducing inflation expectations and restoring confidence in monetary policy.

1.1 ALTERNATIVE INVESTING AND THE NEED TO UPGRADE RISK MANAGEMENT SYSTEMS

At the end of 2011, private equity funds, hedge funds and funds investing in real assets were estimated to be managing around USD 4 trillion. This amount may still seem small compared with the size of the global equity and debt securities markets, whose volume totalled almost USD 150 trillion in 2010. However, the market for alternatives has grown much faster than traditional investments. Just three decades ago alternative assets totalled only a few billion US dollars, implying a compound annual growth rate of more than 25%. For some investors, especially endowments, foundations and family offices, alternative investing is no longer considered a niche strategy, but instead is part of their core portfolio. In fact, some asset allocators have invested as much as half their capital in alternatives, a few individual institutions even more. Pension plans, the largest investors in private equity, real assets and hedge funds, generally have a comparatively less pronounced exposure in terms of the total amount of assets under management (AuM). However, some of the largest pension funds worldwide, such as the California Public Employees' Retirement System (CalPERS), the Canadian Pension Plan Investment Board or the Washington State Investment Board, have invested 20% and more of their assets in alternatives.

The United States has remained the largest market for alternative investing, absorbing more than 50% of the capital deployed in private equity, real assets and hedge funds. At the same time, US investors have been the world's largest capital source for alternative investments. However, Europe and, more recently, advanced Asia and emerging economies have been playing catch-up, both as a destination and source of capital. As regards the latter, sovereign wealth funds (SWFs) have played a particularly important role, helping recycle their countries' current account surpluses and raising foreign exchange reserves by investing in asset classes whose liquidity characteristics make them inaccessible for central banks. Thus, alternative investing has become a global business, with cross-border transactions helping regional markets become increasingly integrated.

However, it appears that the development of investors' risk management capabilities has not always kept pace with their growing exposure to alternative assets. During the global financial crisis in 2008–2009, a significant number of investors, and especially those with a substantial exposure to alternative assets, were faced with an acute lack of liquidity. The sudden shortage of liquidity took investors by surprise. The majority of them had based their liquidity planning on cash flow models whose parameters were essentially static. However, as financial markets shut in the wake of the collapse of Lehman Brothers in the autumn of 2008, the model parameters shifted rapidly due to sharply reduced distributions from private equity funds and similar partnerships investing in real assets, the suspension of redemptions by hedge funds, and increased margin calls and collateral. Many institutional investors thus found that their short-term liabilities either proved to be much more inflexible than they had thought or rose unexpectedly in the face of the crisis.

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!